WIP Calculation Made Easy! Manufacturing Guide [Explained]

Work-in-progress (WIP), a crucial metric for Lean Manufacturing principles, represents partially completed goods. Accurately determining how to calculate WIP in manufacturing requires a sound understanding of material costs. Leading organizations, like APICS, emphasize the importance of WIP tracking for efficient inventory control. Furthermore, the MRP (Material Requirements Planning) system relies on precise WIP data to optimize production schedules. The balance sheet is a record of assets, liabilities, and equity, including WIP, which requires accurate valuations.

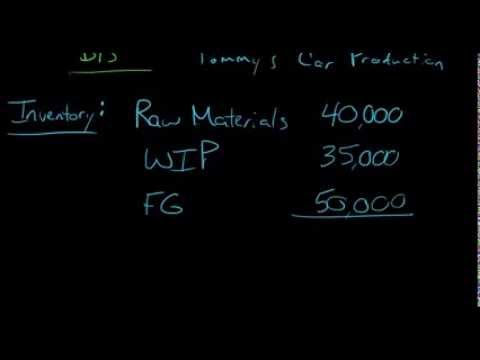

Image taken from the YouTube channel Edspira , from the video titled Work in Process (WIP) Inventory .

In the dynamic world of manufacturing, understanding and managing your assets is paramount. One often-overlooked but critically important asset is Work in Progress, or WIP.

WIP represents the value of partially completed goods currently in the production process. It's the bridge between raw materials and finished products, encompassing everything from the initial stages of assembly to items nearing completion.

Accurately tracking and valuing WIP is not merely an accounting exercise. It is a fundamental requirement for maintaining financial health, making informed strategic decisions, and driving operational efficiency within a manufacturing business.

This guide aims to demystify WIP, providing a clear and comprehensive understanding of its calculation, management, and strategic importance. Let's begin by defining what WIP actually is and why it matters so much in manufacturing.

What is Work in Progress (WIP)?

WIP inventory encompasses all materials and components that have been committed to the production process but have not yet reached the stage of finished goods.

Think of it as everything on the factory floor that's in the middle of being made. This includes raw materials that have been released to production, components being assembled, and partially completed products undergoing various stages of manufacturing.

The Significance of WIP in Manufacturing

WIP is a significant asset for many manufacturing companies, and its value can have a substantial impact on the balance sheet. Inefficiently managed WIP can tie up significant capital, increase storage costs, and lead to potential obsolescence.

Conversely, effectively managed WIP can streamline production, reduce lead times, and improve responsiveness to customer demand.

Why Accurate WIP Calculation Matters

Accurate WIP calculation is essential for several key reasons:

-

Financial Reporting: WIP is a crucial component of inventory valuation, which directly impacts a company's reported assets, cost of goods sold (COGS), and ultimately, its profitability. Misstated WIP can lead to inaccurate financial statements, potentially misleading investors and other stakeholders.

-

Informed Decision-Making: Understanding the true value of WIP provides insights into production efficiency, bottlenecks, and potential cost overruns. This information is invaluable for making informed decisions about production planning, resource allocation, and pricing strategies.

-

Performance Measurement: Tracking WIP levels and associated costs allows manufacturers to monitor performance against established targets and identify areas for improvement. It can also help in evaluating the effectiveness of different production processes and techniques.

-

Cost Control: By carefully monitoring WIP, manufacturers can identify and address inefficiencies that contribute to higher production costs. This can include excessive material waste, labor inefficiencies, or delays in the production process.

Who Should Read This Guide?

This guide is designed to be a valuable resource for a wide range of professionals involved in the manufacturing industry. This includes:

-

Manufacturing Accountants: Those responsible for accurately valuing inventory and preparing financial statements.

-

Plant Managers: Who need to understand WIP to optimize production processes and control costs.

-

Business Owners: Who need to make informed decisions about resource allocation and overall business strategy.

-

Operations Managers: Who are focused on improving efficiency and reducing waste throughout the production cycle.

By mastering the principles and techniques outlined in this guide, you can gain a deeper understanding of WIP and its critical role in achieving manufacturing excellence.

In the previous section, we defined WIP and highlighted its general importance. Now, let’s move beyond the surface and dissect the essence of Work in Progress. Understanding its components and its role within the manufacturing ecosystem is crucial for effective management and cost optimization.

Understanding the Essence of Work in Progress (WIP)

To truly grasp the significance of WIP, it’s essential to move beyond a simple definition and delve into a more granular understanding of its composition and function. WIP isn't a monolithic entity; it's a collection of assets at various stages of completion, each contributing to its overall value.

Deconstructing WIP Inventory: A Detailed Look

Work in Progress inventory represents the cumulative value of all materials and resources applied to products that are not yet finished goods. It's a dynamic figure that changes constantly as production progresses.

Think of a batch of chairs being manufactured. At one point, the WIP inventory might only consist of the raw wood. Then, as the wood is cut, shaped, and assembled, the WIP inventory grows, reflecting the added labor and applied overhead.

This value encompasses the direct costs of materials and labor, as well as a portion of the manufacturing overhead allocated to the production process. Accurately accounting for each of these components is critical for a true valuation.

The Triad of WIP Components: Direct Materials, Direct Labor, and Overhead Costs

The value of WIP is built upon three fundamental components: Direct Materials, Direct Labor, and Overhead Costs. Each plays a distinct role in determining the total value of partially completed goods.

Direct Materials: The Foundation

Direct materials are the raw materials and components that are directly incorporated into the finished product. These are the tangible ingredients that make up the final item.

Tracking direct materials involves monitoring the quantity and cost of materials issued to production. Common inventory valuation methods like FIFO (First-In, First-Out) or weighted average costing are often used to determine the cost of materials consumed.

Direct Labor: The Transformation

Direct labor represents the wages and benefits paid to workers who are directly involved in the manufacturing process. This includes assembly line workers, machinists, and other personnel who actively transform raw materials into finished goods.

Accurately tracking direct labor costs requires recording the time spent by each worker on specific production tasks. This data is then used to calculate the labor cost associated with each unit of WIP.

Overhead Costs: The Supporting Structure

Overhead costs encompass all other manufacturing costs that are not directly traceable to specific products. These are the indirect expenses that support the production process as a whole.

Examples of overhead costs include factory rent, utilities, depreciation of manufacturing equipment, and the salaries of indirect labor personnel (e.g., supervisors, maintenance staff).

Allocating overhead costs to WIP requires using a predetermined allocation method, such as machine hours, labor hours, or activity-based costing (ABC). The chosen method should accurately reflect the consumption of overhead resources by the production process.

WIP's Role in the Production Process: A Crucial Intermediary

WIP occupies a critical position within the broader production process, acting as the bridge between raw materials and finished goods. Understanding its role is crucial for optimizing production flow and minimizing waste.

WIP represents the inventory in motion. It's the manifestation of the transformation process, as raw materials are progressively converted into finished products through various stages of manufacturing.

Effectively managing WIP involves controlling the flow of materials through the production process, minimizing bottlenecks, and ensuring that production schedules are aligned with demand. High levels of WIP can indicate inefficiencies in the production process, such as long lead times, excessive inventory, or poor coordination between departments. By carefully monitoring and managing WIP levels, manufacturers can identify and address these issues, leading to improved operational efficiency and reduced costs.

Understanding the Essence of Work in Progress (WIP)

To truly grasp the significance of WIP, it’s essential to move beyond a simple definition and delve into a more granular understanding of its composition and function. WIP isn't a monolithic entity; it's a collection of assets at various stages of completion, each contributing to its overall value.

Key Components for Accurate WIP Calculation: A Deep Dive

Accurate Work in Progress (WIP) calculation hinges on a thorough understanding of its constituent elements. These aren't just abstract accounting concepts; they represent tangible resources flowing through your production process. A miscalculation in any of these areas can snowball, leading to inaccurate financial reporting and flawed decision-making.

Let's dissect the triad of Direct Materials, Direct Labor, and Overhead Costs to reveal their intricacies and the methodologies for their precise valuation.

Direct Materials: The Foundation of WIP Value

Direct materials are the raw ingredients and components that are directly incorporated into the final product. This category includes everything from lumber in furniture manufacturing to silicon wafers in semiconductor production.

Accurate tracking and valuation of these materials are paramount.

Tracking Methods: FIFO, LIFO, and Weighted Average

Several methods exist for tracking and valuing direct materials, each with its own implications for WIP calculation.

-

FIFO (First-In, First-Out): Assumes that the oldest materials are used first. This method often aligns with the physical flow of inventory and is generally favored when material costs are relatively stable.

-

LIFO (Last-In, First-Out): Assumes the newest materials are used first. While permitted under U.S. GAAP, LIFO is prohibited under IFRS and can create a mismatch between reported costs and the actual physical flow of inventory.

-

Weighted Average: Calculates a weighted average cost based on the total cost of goods available for sale divided by the total units available for sale. This method smooths out price fluctuations and simplifies calculations.

The choice of method depends on factors like industry practices, tax implications, and the volatility of material costs.

Valuation Techniques

Beyond the tracking method, you must also consider the valuation technique. Materials are typically valued at cost, which includes the purchase price, freight, insurance, and other directly attributable costs.

Discounts, rebates, and allowances should be carefully considered and deducted from the purchase price to arrive at the true cost.

Direct Labor: Quantifying Human Effort

Direct labor encompasses the wages, benefits, and payroll taxes associated with the workers directly involved in the manufacturing process.

This includes machine operators, assembly line workers, and anyone whose efforts are directly transforming raw materials into finished goods.

Calculating Labor Costs

Accurately calculating labor costs requires meticulous time tracking and a clear understanding of employee compensation structures.

-

Time Tracking: Implement a robust system for tracking employee time spent on specific production activities. This can involve time cards, electronic time clocks, or more sophisticated enterprise resource planning (ERP) systems.

-

Wages and Benefits: Include all components of employee compensation, such as hourly wages, salaries, overtime pay, bonuses, health insurance, retirement contributions, and paid time off.

-

Payroll Taxes: Factor in employer-paid payroll taxes, such as Social Security, Medicare, and unemployment taxes.

Allocation Methods

Once total labor costs are calculated, they must be allocated to specific products or production batches. Common allocation methods include:

-

Direct Labor Hours: Allocate labor costs based on the number of direct labor hours spent on each product.

-

Machine Hours: Allocate labor costs based on the number of machine hours used to produce each product, assuming that labor is closely tied to machine operation.

-

Activity-Based Costing (ABC): Allocate labor costs based on the specific activities performed by workers and the resources consumed by those activities.

Understanding Overhead Costs: The Indirect Expenses

Overhead costs are all the indirect costs associated with the manufacturing process that cannot be directly traced to specific products.

This broad category includes factory rent, utilities, depreciation on manufacturing equipment, indirect labor (e.g., maintenance staff, supervisors), and factory supplies.

Fixed vs. Variable Overhead

Overhead costs can be classified as fixed or variable:

-

Fixed Overhead: Costs that remain relatively constant regardless of the production volume (e.g., factory rent, insurance).

-

Variable Overhead: Costs that fluctuate with production volume (e.g., utilities, factory supplies).

Allocation Methods: Finding the Right Basis

Allocating overhead costs to WIP requires careful consideration of the allocation base. The allocation base should be a cost driver that has a causal relationship with the overhead costs being allocated.

Common allocation methods include:

-

Direct Labor Hours: Allocate overhead costs based on the number of direct labor hours.

-

Machine Hours: Allocate overhead costs based on the number of machine hours.

-

Direct Material Costs: Allocate overhead costs based on the cost of direct materials used in production.

-

Activity-Based Costing (ABC): Allocate overhead costs based on the specific activities performed in the factory and the resources consumed by those activities. ABC offers a more granular and accurate allocation of overhead costs compared to traditional methods.

The choice of allocation method depends on the nature of the overhead costs and the complexity of the manufacturing process.

Implementing a robust system for tracking, valuing, and allocating direct materials, direct labor, and overhead costs is the bedrock of accurate WIP calculation. Only with this foundation can manufacturers gain a true understanding of their production costs and make informed decisions to improve profitability.

Direct materials, direct labor, and manufacturing overhead form the cornerstones of WIP, and we've explored methods to meticulously track and value each. Now, let's bring all these elements together to execute the actual calculation of Work in Progress. This involves understanding the formula itself, how to properly value the components, and how WIP fits into the bigger picture of manufacturing costs.

Step-by-Step Guide: Mastering the WIP Calculation Formula

The calculation of Work in Progress (WIP) might initially seem daunting, but it's a straightforward process when broken down into manageable steps. This section offers a practical guide to understanding the WIP formula, calculating beginning and ending inventory values, and illustrating the relationship between WIP and the Cost of Goods Manufactured (COGM).

Unveiling the WIP Calculation Formula

The core formula for calculating WIP focuses on tracking the flow of costs into and out of the production process.

It essentially accounts for what you started with, what you added, and what you finished, to determine what remains in WIP.

The formula is expressed as follows:

Ending WIP Inventory = Beginning WIP Inventory + Manufacturing Costs Added - Cost of Goods Manufactured (COGM)

Where:

- Beginning WIP Inventory represents the value of partially completed goods from the previous accounting period.

- Manufacturing Costs Added encompasses all direct materials, direct labor, and manufacturing overhead introduced into production during the current period.

- Cost of Goods Manufactured (COGM) signifies the total cost of goods completed and transferred out of WIP during the current period.

Calculating the Value of Beginning WIP Inventory

Beginning WIP inventory is not created ex nihilo. It is the ending WIP inventory from the previous accounting period.

To determine its value, you need to refer to your previous period's WIP calculation. It represents the cumulative costs already incurred on partially completed goods that are still in production at the start of the current period.

This value should already be available in your accounting records.

Calculating the Value of Ending WIP Inventory

Ending WIP inventory represents the value of all unfinished goods remaining in the production process at the end of the accounting period.

This calculation requires a more detailed approach:

- Identify all units currently in process: Conduct a physical inventory to determine the number of units at each stage of completion.

- Determine the percentage of completion for each unit: Assess how much material, labor, and overhead has been applied to each unit. This is often estimated based on the stage of production.

- Calculate the cost of materials, labor, and overhead applied to each unit: Use your chosen costing method (standard or actual) to determine the cost of each input factor.

- Sum the costs for all units: Add up the costs for all units in process to arrive at the total value of Ending WIP Inventory.

WIP and COGM: An Intertwined Relationship

Work in Progress and Cost of Goods Manufactured (COGM) are intimately linked.

COGM represents the cost of goods that have been completed and moved out of WIP and into finished goods inventory.

The formula for COGM is:

COGM = Beginning WIP Inventory + Total Manufacturing Costs - Ending WIP Inventory

Notice how ending WIP appears as a deduction in the COGM formula.

This highlights that the costs associated with unfinished goods (ending WIP) are not included in the cost of goods manufactured during that period.

Only when those goods are completed in a subsequent period will their costs flow into COGM.

Practical Examples: Standard Costing vs. Actual Costing

To illustrate WIP calculation, let's consider a simplified example using both standard and actual costing methods.

Scenario:

Imagine a furniture manufacturer. At the beginning of the month, they had 50 partially completed tables in WIP.

During the month, they started 200 new tables. By the end of the month, 100 tables were completed and transferred to finished goods inventory. This means 150 tables remain in WIP (50 beginning + 200 started - 100 completed = 150 ending).

Total manufacturing costs incurred during the month were \$30,000.

Standard Costing Method

Under standard costing, predetermined standard costs are used for materials, labor, and overhead.

Let's assume the standard cost per table is \$200.

- Beginning WIP Inventory: Assume the beginning WIP (50 tables) were 50% complete, with a standard cost of \$10,000 (50 tables \$200 50% complete).

- Manufacturing Costs Added: \$30,000.

- COGM: 100 tables completed * \$200 = \$20,000.

- Ending WIP Inventory: \$10,000 (Beginning WIP) + \$30,000 (Manufacturing Costs) - \$20,000 (COGM) = \$20,000. This means the 150 tables remaining in WIP are valued at \$20,000 based on their stage of completion and the standard cost per table.

Actual Costing Method

Under actual costing, the actual costs incurred for materials, labor, and overhead are used. This requires meticulous tracking of all costs.

- Beginning WIP Inventory: Assume the beginning WIP was valued at \$9,000 based on actual costs incurred in the previous period.

- Manufacturing Costs Added: \$30,000 (as before).

- COGM: To calculate COGM, you'd need to track the actual costs associated with the 100 completed tables. Let's say those costs totaled \$19,000.

- Ending WIP Inventory: \$9,000 (Beginning WIP) + \$30,000 (Manufacturing Costs) - \$19,000 (COGM) = \$20,000. The 150 tables in ending WIP are valued at \$20,000, reflecting the actual costs incurred to date.

These examples illustrate how the WIP calculation formula works in practice. The key difference lies in how costs are assigned to the units, based on whether you're using standard or actual costing. The correct calculation is crucial for accurate financial reporting and inventory valuation.

Direct materials, direct labor, and manufacturing overhead form the cornerstones of WIP, and we've explored methods to meticulously track and value each. Now, let's bring all these elements together to execute the actual calculation of Work in Progress. This involves understanding the formula itself, how to properly value the components, and how WIP fits into the bigger picture of manufacturing costs.

Costing Methods Demystified: Standard vs. Actual Costing in WIP Calculation

Within the realm of Work in Progress (WIP) calculation, two dominant costing methods vie for prominence: standard costing and actual costing. Understanding the nuances of each method is crucial for accurate financial reporting and informed decision-making. This section will dissect both approaches, providing a comparative analysis and guidance on selecting the optimal method for your specific manufacturing context.

Standard Costing: Setting the Benchmark

Standard costing involves establishing predetermined costs for direct materials, direct labor, and manufacturing overhead. These standard costs are based on historical data, industry benchmarks, or engineering estimates, and they serve as a baseline for evaluating actual performance.

Impact on WIP Calculation

Under standard costing, WIP is valued using these predetermined costs. When goods are transferred out of WIP, the cost of goods manufactured (COGM) is calculated based on the standard cost, regardless of the actual costs incurred.

This approach simplifies the calculation process and provides a readily available benchmark for cost control.

Advantages of Standard Costing

- Simplicity: Streamlines the calculation process, reducing complexity and administrative burden.

- Cost Control: Facilitates variance analysis, enabling managers to identify and address deviations from expected costs.

- Budgeting: Provides a solid foundation for budgeting and forecasting future production costs.

Disadvantages of Standard Costing

- Inaccuracy: May not accurately reflect actual costs, especially in volatile market conditions.

- Variance Analysis Overhead: Requires ongoing variance analysis to identify and reconcile differences between standard and actual costs.

- Potential for Obsolete Standards: Standards must be updated regularly to remain relevant and accurate.

Actual Costing: Reflecting Reality

Actual costing, conversely, uses the actual costs incurred for direct materials, direct labor, and manufacturing overhead in the WIP calculation. This method requires meticulous tracking of all costs as they flow through the production process.

Impact on WIP Calculation

With actual costing, WIP is valued based on the actual costs of materials, labor, and overhead consumed in production. COGM is then calculated using these actual costs, providing a more precise reflection of the true cost of goods manufactured.

Advantages of Actual Costing

- Accuracy: Provides a more accurate representation of actual production costs.

- Detailed Insight: Offers greater visibility into cost drivers and areas for potential cost reduction.

- Compliance: May be preferred for compliance with certain accounting standards or regulatory requirements.

Disadvantages of Actual Costing

- Complexity: Requires detailed tracking of all costs, increasing administrative burden and complexity.

- Delayed Information: Cost information may not be available until the end of the accounting period.

- Potential for Volatility: Fluctuations in actual costs can lead to volatility in product costs.

Standard Costing vs. Actual Costing: A Head-to-Head Comparison

| Feature | Standard Costing | Actual Costing |

|---|---|---|

| Cost Basis | Predetermined standard costs | Actual costs incurred |

| WIP Valuation | Standard costs | Actual costs |

| COGM Calculation | Standard costs | Actual costs |

| Complexity | Simpler | More complex |

| Accuracy | Less accurate | More accurate |

| Cost Control | Facilitates variance analysis | Requires detailed cost tracking |

| Information Timeliness | More timely | Delayed |

Choosing the Right Method: Matching Costing to Manufacturing

The selection of the appropriate costing method depends on the specific characteristics of your manufacturing operation.

-

High-Volume, Standardized Production: Standard costing is often well-suited for high-volume production environments where products are relatively homogenous and cost fluctuations are minimal.

-

Low-Volume, Customized Production: Actual costing may be more appropriate for low-volume, customized production where each product is unique and cost fluctuations are significant.

-

Make-to-Stock vs. Make-to-Order: Make-to-stock environments often benefit from the simplicity of standard costing, while make-to-order environments may require the accuracy of actual costing.

Ultimately, the optimal costing method is the one that provides the most relevant and reliable information for decision-making while balancing the costs and benefits of implementation. Careful consideration of your manufacturing processes and information needs will guide you to the right choice.

Direct materials, direct labor, and manufacturing overhead form the cornerstones of WIP, and we've explored methods to meticulously track and value each. Now, let's bring all these elements together to execute the actual calculation of Work in Progress. This involves understanding the formula itself, how to properly value the components, and how WIP fits into the bigger picture of manufacturing costs.

Best Practices for WIP Management and Ensuring Accuracy

Effective management of Work in Progress (WIP) is not merely about calculation; it's about building a robust system that ensures accuracy, efficiency, and control throughout the manufacturing process. Accurate WIP values are fundamental to reliable financial statements, informed operational decisions, and ultimately, profitability. This section will outline key best practices, providing a framework for optimizing your WIP management.

The Foundation: Accurate Data Collection and Entry

The accuracy of your WIP calculation hinges on the quality of the data that feeds into it. Garbage in, garbage out—this adage rings especially true in manufacturing accounting.

You must meticulously track:

- Material Usage: Record the quantity and cost of all materials entering production, ensuring minimal waste and accurate allocation to specific jobs or batches.

- Labor Hours: Track the time spent by direct labor employees on each product. Implement time-tracking systems, and emphasize accurate reporting.

- Machine Time: For manufacturers using machine-intensive processes, tracking machine time helps allocate depreciation and other machine-related overhead costs accurately.

Without a robust and consistently applied system for data collection, even the most sophisticated WIP calculation method will produce unreliable results.

Regular Reconciliation: Bridging the Gap Between Theory and Reality

Theoretical WIP calculations, based on data entries, should regularly be reconciled with a physical inventory count. This reconciliation process identifies discrepancies arising from:

- Unrecorded Waste: Materials lost or wasted during production that weren't properly documented.

- Theft or Damage: Unaccounted-for inventory losses that impact WIP value.

- Data Entry Errors: Mistakes made during the recording of material usage, labor hours, or other relevant data.

Regular reconciliation helps expose and correct these errors, maintaining the integrity of your WIP figures. Discrepancies should be investigated, and corrective actions must be implemented to prevent recurrence.

Inventory Management: The Linchpin of WIP Accuracy

Effective inventory management practices are intertwined with accurate WIP tracking. Techniques such as:

-

Cycle Counting: Regularly counting a small subset of inventory items helps identify discrepancies and correct errors on an ongoing basis, preventing large-scale inaccuracies at the end of the accounting period.

-

ABC Analysis: Categorizing inventory based on value (A items being the most valuable, C items the least) allows you to focus your control efforts on the items that have the most significant impact on WIP value. This prioritizes resource allocation.

-

FIFO and LIFO: Choosing and consistently applying a suitable inventory costing method (First-In, First-Out or Last-In, First-Out) impacts the valuation of direct materials in WIP.

Well-managed inventory minimizes losses, reduces the risk of obsolescence, and provides a more accurate picture of the materials flowing into and out of the production process.

Understanding the Production Process: From Raw Materials to Finished Goods

A deep understanding of your manufacturing process is crucial for accurate WIP tracking. This knowledge allows you to:

- Identify Key Stages: Pinpoint the critical stages in the production process where WIP is accumulated and value is added.

- Track Material Flow: Accurately trace the movement of materials from raw materials inventory to WIP and finally to finished goods.

- Allocate Costs Effectively: Understand how costs are incurred at each stage of production, enabling more precise allocation of direct labor and overhead.

By thoroughly understanding the process, you can create a more robust and accurate WIP tracking system, leading to better cost control and more informed decision-making.

Direct materials, direct labor, and manufacturing overhead form the cornerstones of WIP, and we've explored methods to meticulously track and value each. Now, let's bring all these elements together to execute the actual calculation of Work in Progress. This involves understanding the formula itself, how to properly value the components, and how WIP fits into the bigger picture of manufacturing costs.

Overcoming Common Challenges in WIP Calculation

No matter how robust your systems, challenges inevitably arise when calculating Work in Progress (WIP). Identifying and addressing these challenges proactively is crucial for maintaining accurate financial reporting and making informed operational decisions. This section will explore common pitfalls in WIP calculation and offer practical strategies for overcoming them.

Identifying and Correcting Errors in WIP Calculation

One of the most significant challenges is ensuring the accuracy of the data used in WIP calculations. Errors can creep in at various stages, leading to skewed results and potentially misleading financial statements.

Common Sources of Errors

Incorrect Material Usage: This can occur due to inaccurate inventory counts, errors in recording material quantities issued to production, or even simple data entry mistakes. Regular physical inventory checks and robust material requisition processes are essential for mitigating this risk.

Misallocation of Overhead: Overhead costs, such as rent, utilities, and depreciation, must be allocated to WIP based on a predetermined allocation method (e.g., direct labor hours, machine hours). Choosing an appropriate allocation base and consistently applying it are vital. Errors can also occur if the overhead rate itself is not accurately calculated.

Labor Hour Inaccuracies: Inaccurate time tracking by direct labor employees can significantly impact WIP calculations. Implementing reliable time-tracking systems and providing adequate training to employees on proper reporting procedures are crucial.

Corrective Actions

Implement Regular Audits: Periodic audits of WIP calculations can help identify discrepancies and underlying issues. These audits should involve reviewing source documents, verifying data accuracy, and ensuring adherence to established procedures.

Establish Clear Reconciliation Processes: Regular reconciliation of WIP inventory with physical counts is essential. Any discrepancies should be investigated and resolved promptly. This might involve adjusting inventory records, investigating the root cause of the error, and implementing corrective actions to prevent recurrence.

Refine Data Entry Procedures: Implement controls to minimize data entry errors, such as using validation rules, double-checking entries, and providing clear instructions to personnel responsible for data entry.

Dealing with Fluctuating Costs

The cost of direct materials, direct labor, and overhead can fluctuate significantly due to market conditions, supplier pricing changes, or internal operational factors. These fluctuations can complicate WIP calculations and make it challenging to accurately value inventory.

Strategies for Managing Cost Fluctuations

Weighted Average Costing: This method calculates the weighted average cost of materials based on the total cost of goods available for sale divided by the total units available for sale. It smooths out cost fluctuations and provides a more stable cost basis for WIP calculations.

Standard Costing with Variance Analysis: While standard costing involves using predetermined standard costs, it's essential to perform variance analysis to identify significant deviations between actual costs and standard costs. These variances can then be investigated and addressed to improve cost control and accuracy.

Hedging Strategies: For manufacturers exposed to significant price volatility in raw materials, hedging strategies can be used to mitigate risk. This involves entering into contracts to lock in future prices, providing more predictable cost inputs for WIP calculations.

Improving Accuracy and Efficiency in WIP Tracking

Beyond simply correcting errors and managing cost fluctuations, proactive measures can be taken to improve the overall accuracy and efficiency of WIP tracking.

Technology Solutions

Barcoding and RFID Technology: Implementing barcoding or RFID technology can automate data collection and improve the accuracy of inventory tracking. This allows for real-time visibility into the movement of materials through the production process, reducing the risk of errors and improving efficiency.

Enterprise Resource Planning (ERP) Systems: ERP systems provide a centralized platform for managing all aspects of the manufacturing process, including inventory management, production planning, and cost accounting. They can automate WIP calculations, improve data accuracy, and provide valuable insights into production costs.

Process Improvements

Streamline Production Processes: Identifying and eliminating bottlenecks in the production process can improve the flow of materials and reduce the amount of WIP inventory. This can also simplify WIP tracking and reduce the risk of errors.

Implement Cycle Counting: Cycle counting involves regularly counting a small subset of inventory items, rather than conducting a full physical inventory count at the end of each period. This can help identify discrepancies early on and improve the accuracy of inventory records.

Establish Clear Roles and Responsibilities: Clearly defining roles and responsibilities for WIP tracking and calculation can help ensure accountability and prevent errors. This includes assigning specific individuals to be responsible for data entry, inventory reconciliation, and variance analysis.

By addressing these common challenges and implementing the strategies outlined above, manufacturers can significantly improve the accuracy and efficiency of their WIP calculations, leading to more reliable financial reporting, better operational decision-making, and ultimately, improved profitability.

Direct materials, direct labor, and manufacturing overhead form the cornerstones of WIP, and we've explored methods to meticulously track and value each. Now, let's bring all these elements together to execute the actual calculation of Work in Progress. This involves understanding the formula itself, how to properly value the components, and how WIP fits into the bigger picture of manufacturing costs.

The Indispensable Role of Cost Accounting in WIP Management

Cost accounting is not merely a compliance exercise; it's the backbone of effective Work in Progress (WIP) management within a manufacturing environment. It provides the framework, the tools, and the insights necessary to accurately calculate, track, and control WIP, ultimately leading to better decision-making and improved profitability.

Cost Accounting's Foundational Role in WIP Calculation

Cost accounting provides the methodological rigor required for accurate WIP valuation. Without it, manufacturers would struggle to assign appropriate costs to partially completed goods, leading to skewed financial reporting and potentially flawed operational strategies.

It establishes the rules for determining how direct materials, direct labor, and manufacturing overhead are allocated to WIP, ensuring consistency and comparability across different production periods.

This involves not just tracking costs, but also analyzing them to identify inefficiencies and areas for improvement. Cost accounting offers established methods like activity-based costing that directly support WIP precision.

Leveraging Cost Accounting Data for Strategic Decision-Making

The data generated through cost accounting provides invaluable insights for a range of critical business decisions. This goes far beyond simple compliance or historical reporting.

Production Planning

By accurately tracking WIP costs, manufacturers can optimize production schedules, identify bottlenecks, and minimize lead times. Detailed cost information can also inform decisions about outsourcing versus in-house production, allowing for a more strategic allocation of resources.

Pricing Strategies

Understanding the true cost of goods, including the WIP component, is essential for setting competitive and profitable prices. Cost accounting helps to ensure that pricing decisions reflect the actual resources consumed in the production process, leading to more sustainable profit margins.

Cost Control Measures

Cost accounting provides the data needed to identify and address cost overruns in the production process. This enables managers to implement targeted cost control measures, improve efficiency, and reduce waste.

Enhancing WIP Tracking Accuracy Through Cost Accounting Practices

Effective cost accounting practices are essential for ensuring the accuracy of WIP tracking. Without them, data quality suffers, leading to unreliable information and flawed decision-making.

Robust Data Collection

Cost accounting emphasizes the importance of collecting accurate and timely data on all aspects of the production process, including material usage, labor hours, and machine time. Implementing robust data collection systems, such as barcoding or RFID technology, is crucial for ensuring data integrity.

Inventory Valuation Methods

The inventory valuation method chosen (e.g., FIFO, LIFO, weighted average) can significantly impact WIP calculations. Cost accounting provides the framework for selecting and consistently applying the most appropriate method for a given manufacturing environment.

Reconciliation Procedures

Regular reconciliation of WIP inventory with physical counts is essential for identifying and correcting errors. Cost accounting provides the tools and techniques needed to perform these reconciliations effectively, ensuring that WIP records accurately reflect the actual state of partially completed goods.

In summary, cost accounting is not merely a support function; it's an integral part of effective WIP management. By providing the data, the insights, and the controls needed to accurately track and value WIP, cost accounting enables manufacturers to make informed decisions, improve efficiency, and achieve sustainable profitability.

Video: WIP Calculation Made Easy! Manufacturing Guide [Explained]

WIP Calculation Made Easy! FAQs

Here are some frequently asked questions regarding Work-in-Progress (WIP) calculation in manufacturing, designed to help you better understand the guide.

What exactly does "WIP" mean in manufacturing?

WIP stands for Work-in-Progress. It represents the value of partially completed goods still on the factory floor. These items have started the manufacturing process but aren't yet finished goods ready for sale. Knowing the WIP value is crucial for understanding your inventory costs.

Why is calculating WIP important for manufacturing businesses?

Calculating WIP accurately helps you understand the true cost of your products. It also provides insights into production efficiency, identifies bottlenecks, and improves inventory management. Accurately knowing how to calculate WIP in manufacturing enables better cost control and profitability analysis.

What are the key components needed to calculate WIP?

Generally, calculating WIP involves tracking raw materials, direct labor, and manufacturing overhead costs. These costs are allocated to the unfinished products in the manufacturing process. Proper tracking systems are essential for accurate WIP valuation. Understanding how to calculate WIP in manufacturing starts with identifying these cost elements.

How does an accurate WIP calculation impact financial reporting?

Accurate WIP calculation directly affects your company's balance sheet and income statement. An overstated WIP can inflate your asset value, leading to an inaccurate financial picture. Getting accurate numbers for how to calculate WIP in manufacturing is critical for compliant and meaningful financial reporting.